Gap cover is a type of insurance product that provides additional financial protection for medical expenses that are not fully covered by your primary medical aid.

Even with a medical aid, you may still be responsible for certain out-of-pocket expenses such as hospital co-payments, deductibles and fees for medical specialists that exceed your medical aid's rates. Gap cover is designed to help cover these additional expenses, so you don't have to pay for them out of your own pocket.

According to a report published by the Council for Medical Schemes (CMS) in 2021, total out-of-pocket payments by medical aid members increased from R29.8 billion in 2016 to R36.7 billion in 2021 at a consolidated scheme level, meaning both open and restricted medical schemes. This equates to 23% more out-of-pocket expenses paid by members from 2016 to 2021.

Be aware though that having gap cover does not mean that all out-of-pocket expenses will automatically be covered. This is a misconception throughout the industry which leads to frustration and confusion from gap cover policyholders.

Gap cover polices are not designed to cover day-to-day shortfalls e.g. medicine and GP visits, and charges once your medical savings account has been depleted.

It is designed to cover in-hospital treatment and procedures and certain defined out-of-hospital procedures.

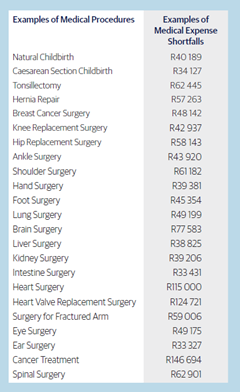

The table below contains some common procedures that frequently result in medical expense shortfalls. Listed too are the Rand amounts that were not covered by the medical aid and required payment by the member. These are actual Liberty Gap Cover claim amounts paid during 2021/2022.

It is highly recommended that you speak to a Financial Adviser when considering which gap cover policy would be best suited to your needs.

Contact your Liberty Financial Adviser today or for more information view the Liberty Gap Cover brochure.

Disclaimer:

This article does not constitute tax, legal, financial, regulatory, accounting, technical or other advice. The material has been created for information purpose only and does not contain any personal recommendations. While every care has been taken in preparing this material, no member of Liberty gives any representation, warranty or undertaking and accepts no responsibility or liability as to the accuracy, or completeness, of the information presented. Please consult your Financial Adviser should you require advice of a financial nature and/or intermediary services.

Liberty Group Limited is a Licensed Life Insurer and an Authorised Financial Services Provider (no 2409). Terms and conditions, risks and limitations apply.